Introduction to Comprehensive Car Insurance

Comprehensive car insurance is a term that gets tossed around frequently in the world of auto insurance, but what does it truly entail? This policy is designed to cover a broad spectrum of situations that extend beyond collisions. It’s meant to provide vehicle owners with an all-encompassing safeguard against incidents such as theft, vandalism, and certain natural disasters that can cause damage to their vehicles.

What is Comprehensive Car Insurance?

At its core, comprehensive car insurance covers damages to a vehicle that aren’t related to accidents with other vehicles. Unlike collision insurance, which protects against damages resulting from a collision, comprehensive insurance covers incidents often deemed “acts of nature.” This includes anything from storm damage and falling objects to animal strikes and theft.

The primary purpose of comprehensive car insurance is to protect vehicle owners financially from losses that can arise from these non-collision incidents. This type of insurance is typically purchased in combination with other policies, such as liability and collision insurance, to offer full-spectrum protection for your vehicle.

How Comprehensive Car Insurance Differs from Other Types of Car Insurance

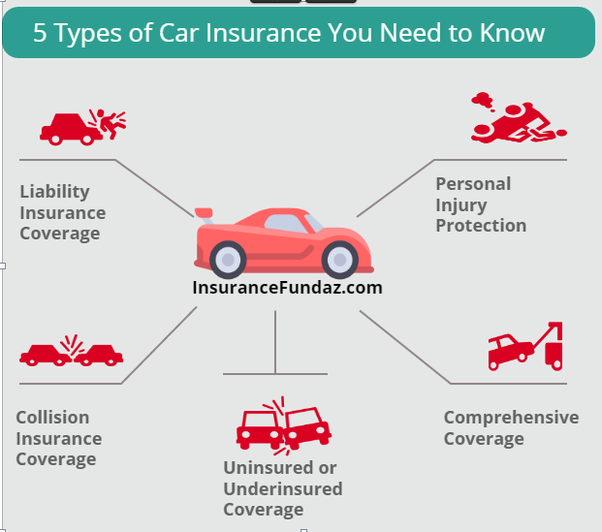

Understanding how comprehensive car insurance works also means understanding how it stands apart from other forms of car insurance. Here’s a breakdown of the major types:

Liability Insurance

Liability insurance is often a legal requirement and primarily covers damages to other people or their property in an accident where the policyholder is at fault. It does not cover the policyholder’s vehicle, which is where comprehensive insurance can be essential.

Collision Insurance

Collision insurance specifically covers damages resulting from accidents involving another vehicle or object, like a pole or guardrail. While it addresses repairs for such damages, it won’t cover incidents like vandalism or weather-related damages, which are covered by comprehensive insurance.

Uninsured Motorist Coverage

This coverage protects against damages caused by uninsured or underinsured drivers. However, it doesn’t include non-collision-related incidents, leaving a coverage gap that comprehensive insurance fills.

Benefits of Comprehensive Car Insurance

Financial Protection

Comprehensive car insurance provides robust financial security for vehicle owners. It covers repairs or replacements following unexpected incidents, reducing the need to pay hefty out-of-pocket expenses.

Peace of Mind

Knowing your car is protected from a wide range of risks can provide peace of mind. Comprehensive coverage ensures that regardless of the situation, you’re prepared for potential damages from various unforeseen circumstances.

Coverage Inclusions in Comprehensive Car Insurance

A comprehensive insurance policy covers several types of non-collision incidents. Here are some of the key inclusions:

Theft

Comprehensive insurance covers the theft of your vehicle or parts of it. Given the increasing rates of auto theft, this protection can be invaluable for car owners.

Vandalism

If your vehicle is intentionally damaged by another person, such as through broken windows or scratches, comprehensive insurance can cover the repair costs.

Natural Disasters

From floods and storms to hail and earthquakes, natural disasters can lead to significant damage. Comprehensive insurance can cover these events, ensuring you won’t be left to manage costly repairs alone.

What Comprehensive Car Insurance Does Not Cover

Comprehensive car insurance is extensive but doesn’t cover everything. Some areas it typically doesn’t cover include:

- Collision damages: Any damages from collisions with other vehicles or objects.

- Personal injuries: Injuries sustained by the driver or passengers in an accident.

- Mechanical breakdowns: General wear and tear or breakdowns due to mechanical issues are not covered.

Factors Influencing the Cost of Comprehensive Car Insurance

The cost of comprehensive insurance can vary significantly based on a few important factors:

Vehicle Make and Model

High-value or luxury vehicles often come with higher insurance premiums because they are more costly to repair or replace.

Location

Areas prone to theft or severe weather events may have higher insurance premiums due to the increased risk of incidents.

Driving History

A history of traffic violations or previous claims can increase premiums. Conversely, a clean record may help lower the cost.

Who Needs Comprehensive Car Insurance?

Comprehensive insurance isn’t for everyone, but it’s especially beneficial if you:

- Live in an area prone to severe weather or high crime rates.

- Own a high-value vehicle that would be costly to repair or replace.

- Want peace of mind knowing your car is covered against various non-collision incidents.

How to Determine the Right Amount of Coverage

Determining the right amount of comprehensive insurance coverage requires a careful look at your specific needs and circumstances.

Assessing Your Needs

Consider your vehicle’s age, value, and potential risks in your area. If your car is relatively new or high-value, a comprehensive policy may be well worth the investment.

Evaluating Risks

Review the likelihood of incidents like theft or natural disasters in your location. High-risk areas may justify a higher level of coverage.

How to File a Claim with Comprehensive Car Insurance

In the event of a covered incident, filing a claim is a straightforward process. Here’s what you’ll typically need to do:

- Document the Damage: Take photos and gather evidence of the damage for your insurer.

- Contact Your Insurer: Inform them of the incident as soon as possible.

- Provide Necessary Information: Submit all required documentation, including repair estimates, police reports (if applicable), and receipts.

Factors to Consider When Choosing a Comprehensive Car Insurance Policy

Choosing a policy involves more than just cost. Look for:

Company Reputation

Research the insurance company’s history of customer service, claims handling, and customer satisfaction to ensure you’re choosing a reputable provider.

Customer Support

Consider the quality of customer support. A responsive and supportive team can make a big difference when you need assistance or file a claim.

How to Save Money on Comprehensive Car Insurance Premiums

Several strategies can help reduce the cost of comprehensive insurance:

- Bundle Policies: Many insurers offer discounts when you bundle comprehensive coverage with other policies.

- Increase Deductibles: Opting for a higher deductible can lower your premium, but be prepared to cover more out-of-pocket costs if you file a claim.

- Utilize Discounts: Look for discounts, such as safe driver, good student, or anti-theft discounts.

Myths about Comprehensive Car Insurance

There are many misconceptions about comprehensive insurance. Here are a few common ones:

- Myth: Comprehensive insurance covers everything. Comprehensive insurance covers many non-collision events but not everything. Always review policy details.

- Myth: It’s only for expensive cars. Comprehensive coverage is beneficial for various car types, not just high-end vehicles.

How to Switch to Comprehensive Car Insurance from Another Policy

Switching to comprehensive car insurance is a straightforward process that can often be done with your current insurer or by choosing a new provider. Here’s a step-by-step guide to help you make the transition:

- Evaluate Your Current Policy: Review the coverage you currently have and identify gaps that comprehensive insurance could fill, such as protection against theft or vandalism.

- Research Comprehensive Insurance Options: Check out different insurance providers and compare their comprehensive coverage offerings, costs, and customer service ratings.

- Request Quotes: Contact various insurers to get a detailed quote for comprehensive coverage based on your vehicle, driving history, and other personal factors.

- Make the Switch: Once you’ve selected a new policy, contact your current insurer to cancel your old policy. Ensure that your new policy begins before your old one ends to avoid any lapses in coverage.

- Review Your Coverage Regularly: It’s essential to periodically assess your insurance needs to ensure that your policy remains aligned with any changes in your lifestyle, vehicle use, or financial situation.

Conclusion: Is Comprehensive Car Insurance Worth It?

For many vehicle owners, comprehensive car insurance offers valuable peace of mind by providing a financial safety net against a range of unforeseen, non-collision incidents. While comprehensive insurance isn’t mandatory and may not be essential for all drivers, it can be particularly beneficial for those who own high-value vehicles, live in high-risk areas, or simply want extra protection against life’s uncertainties. Ultimately, comprehensive car insurance offers an added layer of security, making it a worthwhile consideration for those who want to ensure full-spectrum coverage for their vehicle.

FAQs on Comprehensive Car Insurance

1. Does comprehensive car insurance cover everything?

No, comprehensive insurance does not cover everything. It covers non-collision incidents like theft, vandalism, and certain natural disasters, but it won’t cover collision-related damages, personal injuries, or regular wear and tear.

2. Is comprehensive car insurance required by law?

No, comprehensive car insurance is typically optional and not required by law. However, it can be required by lenders if you’re financing or leasing your vehicle, as it protects their investment.

3. How much does comprehensive car insurance cost?

The cost of comprehensive insurance varies based on factors like your vehicle’s value, where you live, your driving history, and the deductible you choose. On average, it tends to be more affordable than collision coverage.

4. Can I get comprehensive insurance for an older car?

Yes, you can get comprehensive insurance for an older car, but it may not always be cost-effective. Consider the value of your vehicle and potential repair costs before deciding.

5. Will comprehensive insurance cover a rental car?

Comprehensive insurance may cover a rental car if your policy includes rental car reimbursement. However, it’s essential to check with your insurer, as coverage for rental vehicles can vary.